A flat interest rate means that the amount of interest paid is fixed and does not reduce as time moves on. In other words, the amount of payable interest does not decrease as the loan gets paid off each month.

if you take a loan of Rs 1, 00,000 with a flat rate of interest of 10% p.a. for 5 years, then you would pay:

Rs 20,000 (principal repayment @ 1, 00,000 / 5) + Rs 10,000 (interest @10% of 1, 00,000) = Rs 30,000 every year or Rs 2,500 per month.

Over the entire period, you would actually be paying Rs. 1, 50,000 (2,500 * 12* 5). Therefore, in this example, the monthly EMI of Rs. 2,500 converts to an Effective Interest Rate of 17.27% p.a.

Advantage

During a regime of credit restriction interest rates rise high, if repo rate is increased. So many borrower prefer flat interest rate to reduce interest liability over the sanction term.

Disadvantage

If there is no credit restriction, interest rates come down due to easy availability of credit. At that time flexible interest rate is preferable as interest burden goes down.

The reducing interest rate on the other hand means that as a payment is made on the principal amount of a loan, the interest payment reduces as well.

if you take a loan of Rs 1, 00,000 with a reducing rate of interest of 10% p.a. for 5 years, then your EMI amount would reduce with every repayment. In the first year, you would pay Rs 10, 000 as interest; in the second year you would pay Rs. 8,000 on a reduced principal of Rs. 80,000 and so on, till the last year, you would pay only Rs. 2,000 as interest. Unlike the fixed rate method, you would end up paying Rs. 1.3 lakh instead of Rs. 1.5 lakh.

Flat interest rates generally range from 1.7 to 1.9 times more when converted into the Effective Interest Rate equivalent.

To convert the Flat to Reducing Interest rate multiply by 1.8.

Why RBI banned Zero EMI

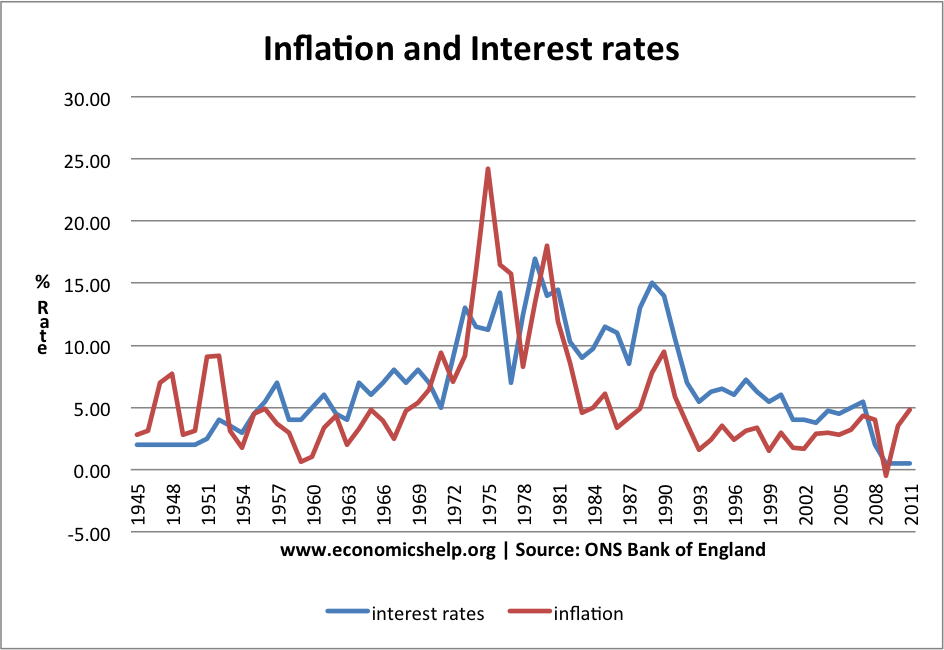

In general, as interest rates are lowered, more people are able to borrow more money. The result is that consumers have more money to spend, causing the economy to grow and inflation to increase. The opposite holds true for rising interest rates.

How could any bank offer any loan at Zero percent when they borrow at a cost from a depositor, pay salaries, rent, admin etc. So they must be charging the customer in some manner to get a return but show zero percent ROI to customer. RBI thought this is not a transparent and fair practice and so stopped it.

certain banks where charging hidden fees from the customers or getting discounts from the manufacturer and not passing it through to the Consumer

Why RBI hikes interest Rates to curb Inflation

Inflation, by definition, is an increase in the price of goods and services within an economy. It’s caused due to an imbalance in the goods and buyer ratio – when the demand of goods or services in an economy is higher than the supply, prices go up. Inflation isn’t necessarily a bad thing. It’s often an indicator of a robust economy and the government usually takes into account a yearly rate of 2% to 3% when it comes to an increase in inflation.

The interest rate is the rate at which interest is paid by borrowers for the use of money that they borrow from creditors.

Lower interest rates translate to more money available for borrowing, making consumers spend more. The more consumers spend, the more the economy grows, resulting in a surge in demand for commodities, while there’s no change in supply. An increase in demand which can’t be met by supply results in inflation.

Higher interest rates make people cautious and encourage them to save more and borrow less. As a result, the amount of money circulating in the market reduces. Less money, of course, would mean that consumers find it more difficult to buy goods and services. The demand is less than the supply, the hike in prices stabilise, and sometimes, prices even come down.

A growing economy might sound like music to your ears, but if you think about it, an economy growing at an alarming rate might not really be the best thing.

In a stable and healthy economy, wage and inflation rise in hand in hand.

A cut in the interest rates right now will devalue the Rupee further. Imports will be more expensive. Inflation will go up.

The ‘Rule of 72‘ is a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors can get a rough estimate of how many years it will take for the initial investment to duplicate itself

Years to double investment = 72/compound annual interest rate